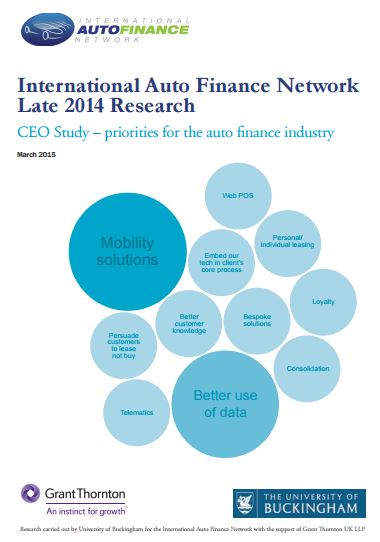

Click here to download the report

Tag Archives: Company cars

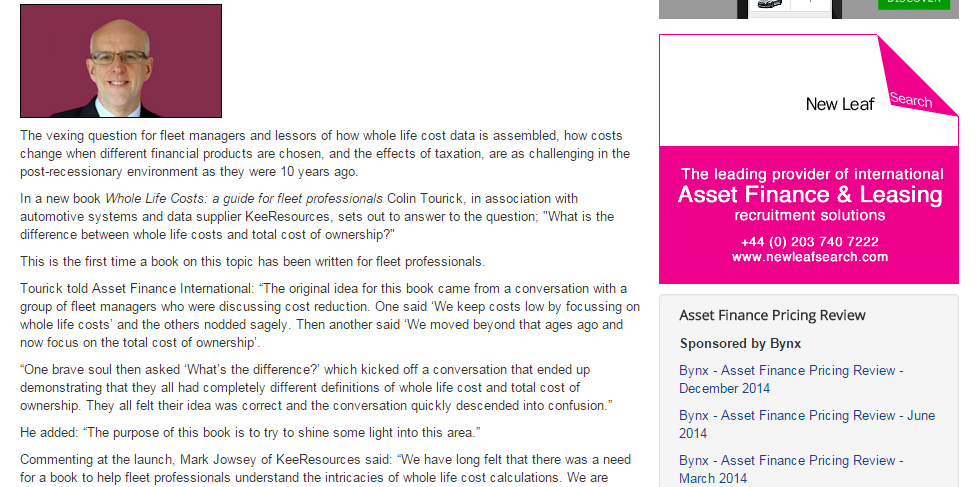

Press coverage of our new Whole Life Costs book

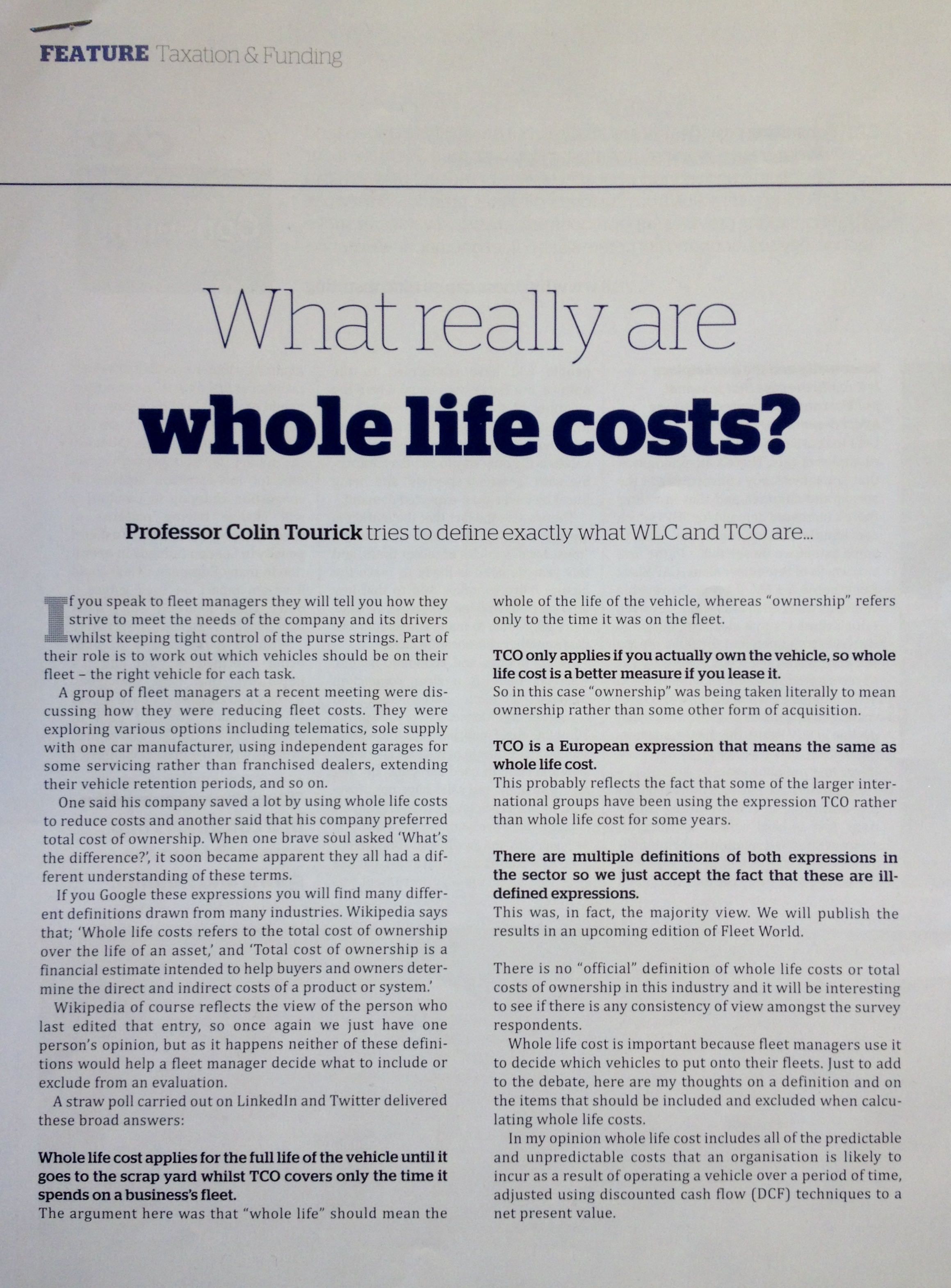

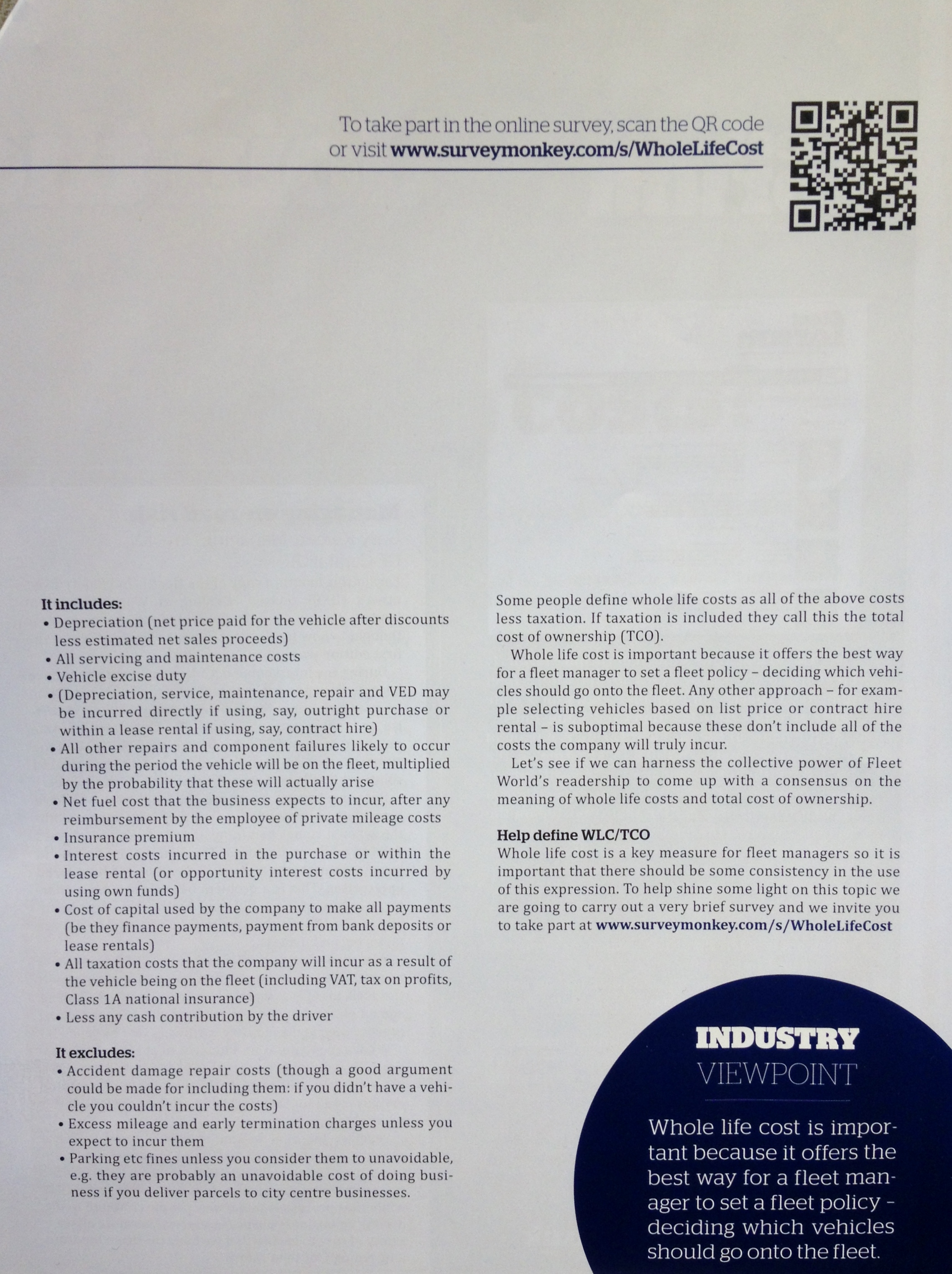

Fleet World articles on whole life costs

Colin Tourick judges Small Fleet Leasing awards

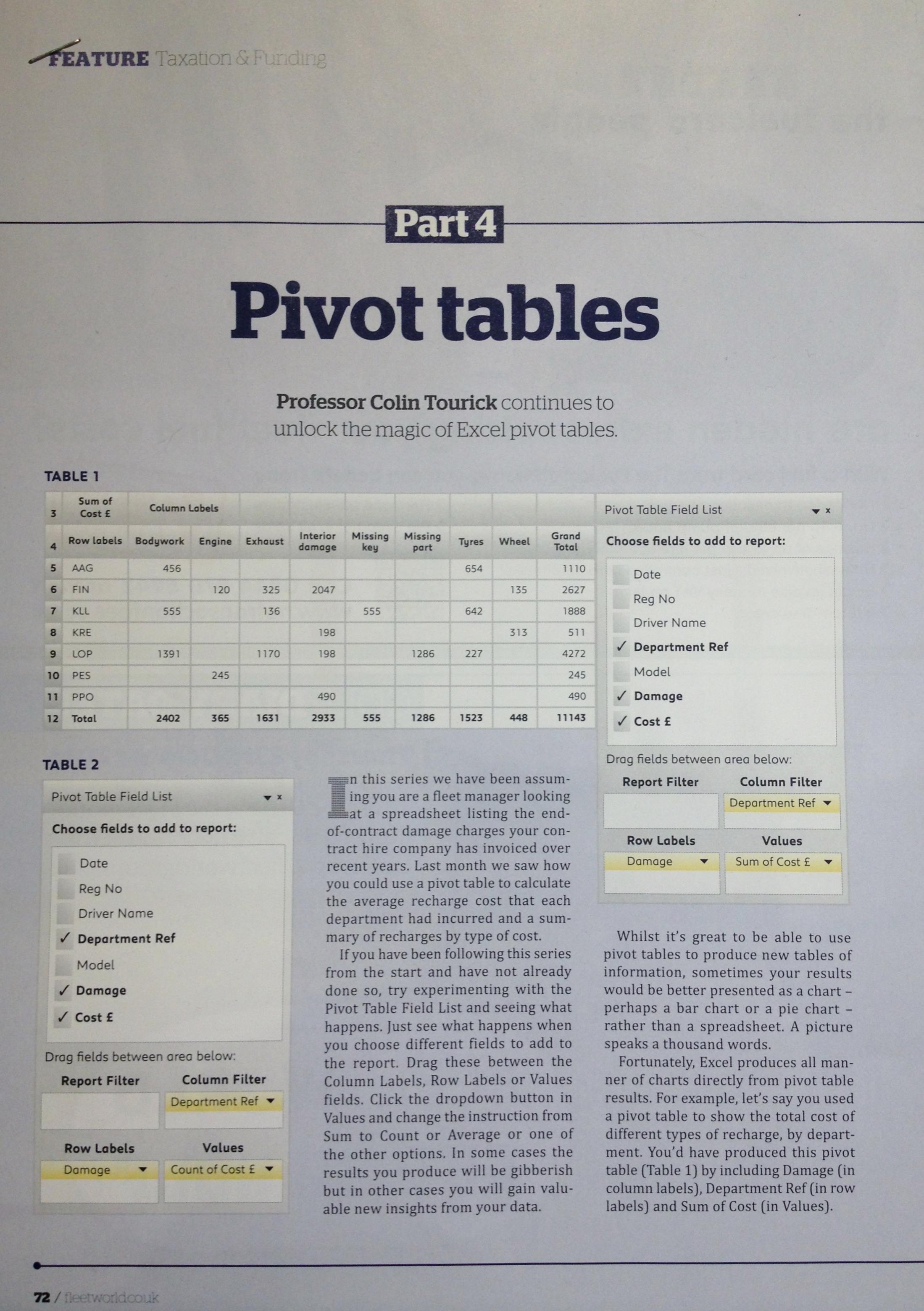

The magic of Excel pivot tables – Fleet World

Article on Company Car & Van Tax 2014-15

Extract from Managing Your Company Cars

What Car published an article about cash-for-car on 29 April 2014 that left out several essential elements. This extract from Managing Your Company Cars fills in the gaps.

>>>

3 CASH-FOR-CAR

C O N C E P T

In concept, this is very simple: your employee gives up their company car and the company pays them more salary.

Increasing levels of car benefit tax in recent years have clearly disadvantaged many company car drivers. For some, the company car no longer represents good value because the tax they pay exceeds the cost they would incur if they simply took extra salary from their employer and acquired their own car. At the same time, some employers believe the administration of a company car fleet is an unnecessary burden. This often occurs in fleets with a high proportion of perk cars where there is no direct business benefit in having company cars, other than as a recruitment and retention tool.

In the mid-1990s American businesses operating in the UK, particularly in financial services, led a move away from company cars. They simply added an amount to their employees’ salaries to compensate for the withdrawal of the car. The perk car culture is less well established in the USA than in the UK and these companies had always questioned whether they should be providing company cars. Rising levels of car benefit tax gave them the opportunity to withdraw this benefit.

When your employee takes extra salary in lieu of a company car, they fall outsidethe benefit-in-kind income tax regime. This saves you having to pay employer’s Class 1A National Insurance contributions

Some of your employees will still need a vehicle in order to carry out their jobs. They will have to provide this themselves, using their increased salary to do so. In addition, you will have to pay them a mileage allowance for each business mile they drive.

There is some evidence that employers who have withdrawn company cars have experienced problems recruiting new staff.

3 . 2 F E AT U R E S

You can choose between several different cash-for-car arrangements.

Many employers have given their staff the option to have a car or take extra salary. Employees like to have a cash option available to them, even when they don’t take it up.

A few employers have downgraded the value of the car on offer and simultaneously given their employees a cash offer to opt out of the company car. The message here is clear: ‘If you want the company to provide you with a car it will do so but it will be a lower grade car than you have been used to. On the other hand, if you opt out of a company car you can take this money and get the car you really want.’

Some employers have introduced employer-sponsored personal contract purchase schemes, in which they introduce their staff to a leasing company that provides fully maintained cars.

Some have introduced employee car ownership schemes (ECOs).

Some employers have stopped providing cars altogether, paid extra salary and left the employees to get on with it.

Quite often, cash-for-car schemes can generate significant savings. You need to decide who will benefit from these.

- Will the company keep the full savings? If so, you may find it hard to encourage employees to opt out of the company car.

- Will the savings be shared between the company and the employees? If so, how much will each party receive?

- Will all the savings be passed to the employees? This will encourage take-up but will not be ideal for the shareholders.

It makes sense to work with a leasing company to introduce a cash-for-car scheme.

You are not going to give an employee a lump sum of thousands of pounds to buy a car. Instead, you will pay them a monthly allowance and they need a way to convert that allowance into mobility. A lease or personal contract purchase agreement allows them to do this.

If you set up such a scheme with a leasing company you can influence the deal your employees receive. In return, you may be asked to deduct the lease payments from the employees’ net pay and pass these direct to the leasing company.

3 . 3 TA X I S S U E S WI T H C A S H-F O R-C A R

The tax rules relating to company cars are set out in Chapter 17.

Given the choice between cash or car, an employee has to decide which to take.

They have to calculate their cash receipts and payments (including tax) under both scenarios. You may wish to follow the example of many employers and help your drivers to understand these calculations or do the calculations for them.

As an employer, you have to be sure that moving to a cash option is the best move for your business.

The calculations for both you and employee are complicated. Doing the sums and explaining them to a single driver is time-consuming but for a large group it is awesome. Employees have had to learn a new language. In the past few years and consultants have earned a great deal introducing these schemes to companies.

Another problem has been that, technically, car benefit charges on company cars are designed to give HM Revenue and Customs a simple method of calculating the benefit that an employee receives when they are given a company car. If employees are offered cash instead of a car, HM Revenue and Customs has the right to tax them on the value of the cash offered, even if they decide to keep the company car.

There is a danger that a badly set up cash-for-car scheme will fail to remove the car benefit tax charge from the employee. Several schemes have failed to pass HM Revenue and Customs’ tests.

You should be wary of giving the funder a guarantee that you will meet your employees’ payment obligations under PCP or PCH arrangements if the employees fail to do so. If you guarantee these obligations it may trigger a tax liability. However, HM Revenue and Customs has approved employee car ownership schemes that feature employers’ guarantees.

If your employee fails to make his or her payments under a finance arrangement, and your business pays this for them, this will be a taxable benefit.

In all cases, you are strongly advised to clear the scheme with HM Revenue and Customs.

If an employee is given cash instead of a car, there will be no car benefit tax to pay on a company car. If the employer pays a high level of mileage allowance to the employee for using his own car, a high business mileage driver can potentially make a tax saving compared with taking a company car, particularly if he drives a car emitting high levels of carbon dioxide.

N A T I O N A L I N S U R A N C E A N D C A S H-F O R-C A R

If you offer a cash allowance instead of a company car, you will save the cost of the Class 1A National Insurance contributions you would otherwise have to pay.

Any cash allowance you pay to an employee in lieu of his company car will be fully taxable in the hands of the employee at their marginal rate of tax.

You will pay Class 1 employer’s National Insurance contributions on the cash allowance.

The employee will pay Class 1 NIC on the cash allowance.

M I L E A G E A L L O WA N C E S A N D C A S H -F O R -C A R

You will need to pay a mileage allowance to the employee who uses his or her private vehicle on company business.

The allowance can be any amount you agree with the employee. So long as this is not above the level of HM Revenue and Customs Approved Mileage Allowance Payments (AMAP) the employee will not have a tax liability on these payments. If the mileage rate paid is less than the AMAP, the employee will be able to claim the shortfall as an additional amount of tax relief in their tax return.

If the payment exceeds the AMAP levels, the excess over the AMAP level will be taxable at the employee’s marginal rate.

If you wish to adopt a cash-for-car scheme, it makes sense to pay the employee the full amount of the AMAP (on which they pay no tax or National Insurance contributions) and a lower level of cash allowance (on which they pay tax and possibly Class 1 National Insurance, and on which the employer pays Class 1A National Insurance).

This could be better than paying a higher cash allowance and a lower mileage rate.

If you wish you may give employees interest-free loans of up to £5,000 to help them buy their own vehicles. There is no income tax charge on this benefit so long as the loan is fully repayable, and it is indeed repaid and not written-off. This loan can be used as a deposit towards a finance or lease agreement and it will therefore reduce the monthly payments the employee has to make to the funder/lessor. In practice, most employers prefer not to offer such a loan.

You need to give very careful consideration to setting up a cash-for-car scheme and also decide whether any savings should be kept by the company or shared with the employees.

In recent years we have seen the development of employee car ownership schemes that move all employees en masse out of company cars and into cars they own themselves. These are designed to remove the car from the car benefit tax regime and provide the benefits of some of the tax savings mentioned above.

3 . 4 O P E R AT I O N A L I S S U E S

Selecting, test-driving, buying, maintaining, insuring, arranging roadside recovery and disposing of a car all involve an element of hassle.

With company cars the employer has the hassle, with many cash-for-car arrangements it is left with the employee.

As well as making complex calculations when implementing your cash-for-car scheme, you will have to make some important policy decisions.

In many company car schemes, employees are allowed to select a car from a list, according to their grade within the company. When introducing cash-for-car schemes, many employers have tried to replace these car bands with cash bands – “if you are at such-and-such a grade you are entitled to receive £400 per month instead of a company car”.

They have come up against a major complication. If two employees are earning the same salary and doing the same job, and one drives a high level of business miles and one a low level, giving them the same cash allowance and the same mileage allowance will leave one substantially better off than the other. This means they will be unable to afford the same car. By and large, cash bands do not work well in cash-for-car schemes.

Another issue is that the scheme needs to set out what will happen if a driver changes job inside the organisation and therefore drives a greater or lesser mileage than was originally planned. Who will be responsible for any additional costs or get the benefit of the savings, the employer or the employee?

Motor insurance has proved problematic in some cash-for-car schemes. Employees do not build up any no-claims bonuses while driving the company’s vehicles.

Therefore, some employees who have opted for cash allowances have discovered that motor insurers have quoted very large premiums and have not recognised their years of accident- and claim-free motoring. The better cash-for-car schemes recognise this issue and include arrangements with the companies’ insurers to continue to cover to those staff who move out of company cars. After all, the insurers still want the business and the risk has not changed.

V E H I C L E C H O I C E A N D C A S H -F O R -C A R

Vehicle selection has been an issue in some schemes. Where cars are to be used in your business (for example, by salespeople) you might think it reasonable for you to be able to stipulate the type, age and quality of car that can be used by the employee on company business.

There is a slight problem of course; the employee can reasonably say they should be able to spend their income on whatever they want.

In practice, many cash-for-car schemes limit the range of cars that employees can use on company business. Typical limitations have included: no convertibles, no sports cars, nothing over four years old and no two-door cars.

Many company car schemes are more prescriptive than this, so thousands of employees have enjoyed the newly-found freedom to choose from a much wider range of cars than they could have driven previously and many have selected quality used vehicles to stretch their cash allowance further.

Some schemes allow cash to be deducted from salary and paid by the employer directly to a leasing company. Leasing companies prefer this as it reduces their administration and gives them just one point of contact for payment.

However, for a cash-for-car scheme to work effectively, the employee needs to have a good idea of the level of business mileage they will drive – and many don’t.

Calculating the cash allowance that you will pay the employee is complex. Many employers have started from the viewpoint they will pay a monthly allowance equal to the contract hire rental they had hitherto paid for the employee’s car. In many cases, after this has been added to the employee’s salary and taxed, the employee has not had enough left to lease a car.

If your employees use their own cars on company business, the cars must comply with health and safety legislation. The cars must be properly serviced and maintained, roadworthy and insured for business. These cars should be included in your health and safety assessments.

If you wish to assist your employees to arrange their vehicle finance, perhaps on a personal contract purchase basis, you must consider whether you need to obtain a consumer credit licence from the Office of Fair Trading.

It is not difficult or expensive to obtain a CCA licence but many employers are reluctant to do so because it involves an extra piece of bureaucracy. However, if you introduce your employees to a lessor or lender for the purpose of obtaining consumer finance and you do not have a CCA licence, you will be breaking the law.

It is hard to get the Office of Fair Trading to be prescriptive about where the dividing line exists, beyond which you must obtain a licence. However, it seems that if you simply advertise a leasing company’s PCP scheme on your staff notice board and invite staff to apply direct to the leasing company, you will not require a licence.

At the other extreme, if you handle all of the finance application process, passing the application forms and finance agreements to the staff for completion, getting them back, forwarding them to the leasing company and arranging for the agreements to be signed, you will be doing the same job as a broker and your business has to be licensed.

Your leasing company may tell you that you do not need a CCA licence to introduce a PCP scheme but you should check the principles set out above and reach your own judgement on whether this advice is correct. If they advise you incorrectly it will be your company that is breaking the law, not theirs. If you are still in doubt you are advised to get a licence and comply with the legislation.

3 . 5 H U M A N R E S O U R C E S I S S U E S

There is a great deal of disagreement on how employees can be encouraged to take up cash-for-car schemes. Some consultants insist that all employees can be pushed into them on the same day without any problems.

An employee’s terms and conditions of employment are set out in their contract of employment. While this should be very obvious, it is remarkable how many management teams have ignored this simple fact when introducing a cash-for-car scheme. If your company’s standard employment contract says you will provide the employee with such-and-such a car or its equivalent, you must do so. You cannot unilaterally withdraw this benefit.

If the contract says that you can withdraw or modify this benefit at your sole discretion, you are free to make whatever changes you wish, except that you may well have an exceptionally unhappy workforce if you impose a scheme on them.

To avoid staff dissatisfaction most employers have consulted their staff and tried to encourage them to relinquish their cars in favour of cash.

Faced with the withdrawal of their company vehicles, employees are rarely enthusiastic. Once their company cars are gone, many will have to enter into finance agreements to obtain their car, involving a commitment to pay thousands of pounds over a number of years.

In this situation employees find themselves having to think about a number of issues. If they have concerns about job security (for example, if the company has made people redundant recently, or if they have received adverse comments about their personal performance) they will be reluctant to enter into such an obligation.

If they are planning to move home they may have concerns about their ability to raise a mortgage if they have to disclose several thousand pounds of additional indebtedness to potential lenders.

They will also be concerned about the financial aspects of the cash-for-car scheme.

When the scheme is introduced, the employees may calculate that they benefit, or are at least not disadvantaged, by receiving a cash allowance and a mileage allowance. However, if they change jobs internally, perhaps to a role requiring them to drive fewer business miles, this may alter the economics of the cash allowance and make it less beneficial than if they had kept a company car. Maternity leave or illness may keep the driver off the road for several months but the lease payments on the car will still have to be made.

In some cash-for-car schemes the employer organises accident, sickness and redundancy insurance for the employees through an insurance company. It may seem strange for the employer to organise redundancy cover but it provides an important safety net that the employees may need to call on.

Salary is normally the starting point for calculating some employee benefits; particularly pension contributions (depending on whether a defined contribution or defined benefits pension scheme is in place). As a cash-for-car scheme involves adding a sum of money to the employees’ salaries, most schemes specifically state that the cash allowance shall be excluded when calculating pension benefits.

Cash-for-car schemes can be good for companies that have flat grading structures as these schemes do away with overt status symbols.

3 . 6 A D VA N TA G E S A N D D I S A D VA N TA G E S

Introduced correctly, cash-for-car schemes can be motivational. They can allow the individual employee quite a lot of freedom in selecting their own vehicle. The schemes can save money for the employer and some save lot of administration.

Introduced incorrectly they can expose your drivers to financial risks and can have a demotivating effect.

They expose the company to health and safety risks that may be hard to control.

International Auto Finance Network is launched

Colin Tourick & Associates Limited and Asset Finance International have joined forces to launch the International Auto Finance Network (IAFN) – an international forum where leaders in the auto finance industry can meet to consider the challenges and opportunities faced by the industry.

Colin Tourick & Associates Limited and Asset Finance International have joined forces to launch the International Auto Finance Network (IAFN) – an international forum where leaders in the auto finance industry can meet to consider the challenges and opportunities faced by the industry.

The IAFN will initially provide quarterly conferences and a website. Each quarterly conference will include a senior keynote speaker, who will present their comprehensive vision. They will be supported by specialist industry practitioners from across Europe.

The first conference, to be held in Milton Keynes on 23 January 2014, provides a unique opportunity for senior executives to discuss the future of the European auto finance industry: technology, regulation and customer expectations in the fleet leasing industry.

GOLD SPONSOR

FEATURING

- Vahid Daemi, chief executive, LeasePlan Corporation N.V

- Dan Durans, CIS Manager, ARI Fleet

- Colin Tourick, co-founder of International Auto Finance Network, and principal, Colin Tourick & Associates

- Professor Peter Cooke, chair, Centre for Automotive Management, Buckingham University

- Rick Yarrow, chief executive, ExpertEye

- Mike Waters, senior insight consultancy & CSR manager, Arval – BNP Paribas Group

- David Betteley, Global financial services director, Jaguar Landrover

- Richard Schooling, Chief Executive, Alphabet (GB) Limited

- Nick Corrie, Managing Director, Trak Global Solutions

- Paul Gogolinski, Managing Director, Total Fleet Solutions

During the day, Ed White, Chairman of White Clarke Group, will be announcing the winner of International Auto Finance Network’s lifetime achievement award – an award which recognises exceptional contributions to the auto finance industry.

WHO SHOULD ATTEND?

Senior professionals from the auto finance industry.

AGENDA

| 09.00 – 09:50 | Registration |

| 09:50 – 10.00 | Introduction to the International Auto Finance Forum Edward Peck, Asset Finance InternationalSession 1, the future of European Fleet Industry introduced by Brian Rogerson, Asset Finance International |

| 10.00 – 10.45 | Keynote speech: The Future of the European Fleet Industry Vahid Daemi, Chief Executive, LeasePlan Corporation N.V. |

| 10.45 – 10.55 | Q & A |

| 10.55 – 11.25 | Coffee |

| 11.25 – 12.00 | How ‘Big Data’ and technology can add value to what fleet lessors offer Dan Durrans, ARI Fleet |

| 12.00 – 12.10 | Q & A |

| 12.10 – 12.40 | Next generation pricing models Colin Tourick, CT&A |

| 12.40 – 12.50 | Research proposal: why do fleet managers select your brand? Edward Peck, Asset Finance International |

| 12.50 – 13.00 | International Auto Finance Network Lifetime Achievement Award presented by Ed White, chairman of White Clarke Group |

| 13.00 – 14.00 | Lunch |

| 14.00 – 14.05 | Introduction to the afternoon, and Session 2, current international fleet trends, challenges and opportunities Colin Tourick, CT&A |

| 14.05 – 14.20 | Interview with David Betteley – Global financial services director, Jaguar Landrover |

| 14.20 – 14.40 | European Economic data and outlook for the automotive sector Professor Peter Cooke |

| 14.40 – 15.00 | European industry data and forecasts Rick Yarrow, ExpertEye |

| 15.00 – 15.40 | Key regulatory developments for the European market Mike Waters, Arval |

| 15.40 – 16.20 | Session 3 – Panel Discussion Richard Schooling, David Betteley, Professor Peter Cooke, Nick Corrie, Paul Gogolinski Chaired by Colin Tourick |

| 16.20-16.30 | Summing up and CLOSE |

YOU CAN BOOK TICKETS HERE

Want to know more?

Call Edward Peck on +44 (0) 207 617 7830.

Keep up to date with the International Auto Finance Network on Twitter: #AutoFinanceNetwork