Category Archives: news

Auto Finance Software Marketplace – an insider perspective

At the February session of the Buckingham Automotive Forum, Colin Tourick interviewed Dara Clarke, CEO of White Clarke Group. Dara provided valuable insights about the asset finance software market and the interview is reproduced in full here.

Q: White Clarke Group has recently celebrated its 21st anniversary. What have you learned along the way?

A: Technology aside, the biggest single development has been the globalisation of the industry and there have been tough lessons for software solutions providers. The need for a local presence is a given. Apart from cultural differences, it would be difficult otherwise to support clients on a 24/7 basis.

Internalization is very difficult. We tried for years to break into the European and Asian markets but until we had local presence we had no traction. Local requirements differ vastly from one’s perception and clients will not take the risk of hiring outsiders. Internalization is now the big issue facing the industry as legislative requirements, global procurement by the multi nationals and fiscal compliance force clients to use common systems. System providers now have to act accordingly to cater for these trends and client needs. This is why we have invested so heavily establishing hubs in our North American hub in Toronto, Asia Pacific hub in Sydney, and European hub in Germany, with additional local offices in Austria, the USA, China and, shortly, in Brazil.

Another lesson has been the need to stick to the core. A number of companies have already learned that being a generalist does not seem to work. By adopting a very keen focus, we have been able to differentiate ourselves by offering unique insight and highly tailored systems to clients in the fleet, asset and captive finance industry.

Talent is scarce and is becoming even more difficult to find, so we have had to develop our staff by hiring graduates and training them in all aspects of the business. Sometimes we have to hire-in specific skills, but it is becoming increasingly difficult to identify the right talents. We also find that our clients do not have the internal resources they had, say, twenty years ago due to cost reduction. This means large systems implementations are being done by operational staff that still have the day job to do. This is not an ideal situation but one which is faced by all our industry.

It is also important to recognise that this industry is a parish, so one cannot fail or make enemies as a single slipup can ruin a reputation. Reputation is a key factor in winning new business, so having clients who will vouch for you, and the systems you provide, is the best advertising you can get. No one wishes to experiment or invest in bleeding-edge systems, hence the need for good references.

The biggest lesson, though, has to be — innovate or die. The speed of technological change, particularly since the internet became the common means of communication, is so fast that if you get left behind you can fail. When we look at the current competitors compared with those we faced in the early 90s, there are few who have survived and the failures generally can be put down to a failure to invest in talent and technology.

Technology is king. We are now in the ‘Google Age’ and, as such, technology has to cater for this. The necessary infrastructure and components for this new world are very complex. Software Providers need to build a pool of world-class talent that is able to build, deploy and maintain agile systems that are capable of facilitating rapid change.

Q: You have touched on globalization. How does the UK market compare with others?

A: The United Kingdom is more sophisticated in pricing terms than most other markets, to some degree a result of the maturity of its the asset and auto finance industries. Other markets enjoy stronger growth which makes lease business less risky in asset value terms.

Local market-specific pricing demands play very much into our hands as they can easily be configured into the system , given the component based nature of CALMS. This application architecture also allows clients to replace system components such as credit decisioning, collections or remarketing components on a piece meal basis and not have to replace all their systems at once.

Q: What ideas have White Clarke Group come up with that have worked particularly well?

A: I believe the biggest innovations were our development of the first internet-based point of sale system in Europe in 1997, the first JAVA enterprise Wholesale Finance System deployed in Europe in 1999. In the same year, we were the launch-partner with HP and Microsoft for hand-held internet based applications such as vehicle inspection, calculation engines and Whole Audit. We continue to invest in mobile technology and will make some major product announcements later this year about our latest mobile innovations.

In 2000, we commenced the development of a JAVA based processing system including Rules Based Decisioning Engine, Work Flow and Credit Decisioning linked with Document Management and imaging. This has been the biggest innovation and the core of our agile processing innovation, allowing clients to truly automate their processes and change as they wish, redesigning processes to cater for market needs without reference to our developers.

On the Fleet side, we commenced development of a radical redesign of traditional customer and vehicle care again using WEB based technology. Using new technologies, we have been able to automate all the regular processes associated with the industry such as P11D (expenses and benefits) calculation, fines management, vehicle ordering, location and delivery management

Pricing Generally – Our background was in pricing and tax based calculation in web based quote with RVs and SMR costs adjustments on factory fitted options; Profit margins flexible by asset value; preferred option functionality – all provide pricing accuracy across the full range of products, terms and mileages. VWFS UK and LeasePlan are main customers providing thousands of automatic ‘unmanned’ quotes a day via web portals – low overhead business capture

Q: How have client needs changed over the last 25 years?

A: Two changes stand out; clients have embraced innovation and they have embraced globalisation.

Clients now recognise that technology is the key to market advantage and profit enhancement. The GOOGLE-age customer wants instant access to quotations, vehicle specifications, financial approval and ordering. They recognise that any company without instant access suffers a distinct competitive disadvantage. Clients expect sophistication, reliability, performance and delivery on time – at less cost than 25 years ago. This is nothing new but, given the sophistication of the modern infrastructure, it is much more difficult from a technical support perspective. Margins have been squeezed and will continue to be under pressure. Today, the clients are all about innovation. As an example, they are using Apps for the IPhone or iPad, where drivers can book a rental on their hand-held device and even obtain a rental agreement without having any paper, sent straight from an iPad to their inbox.

The second element of change is that clients have expanded enormously in the last 20 years. Multi-product, multi-country availability 24/7 with 99.9 % availability has become a standard requirement, whereas 20 years ago each client subsidiary had nearly full independence. Central technology requirements and standard procurement were unheard of in most cases. Now procurement is a lengthy, complex and exacting process!

Q: How do you think leasing companies’ software requirements are likely to change in the next few years. What are the next ‘big things’ we should be looking out for?

A: Blending of dealer channel and central HQ-based business processes are now a key requirement for all clients. Our own latest solutions assume this multi-channel, multi-product, multi-language approach while catering for the needs of a consumer, dealer, sophisticated fleet user and a web customer, all using the same application.

Technology itself will be a major driver. There has never been as much fragmentation and uncertainty as there is now, all driven by our dependence on a mobile device. Our challenge is to tread carefully between the competing technologies. Eventually, tablets and smartphones will largely replace laptops, not because they are more capable, but because they are more applicable to the way we live. The challenge for software vendors like ourselves is to get to grips with the very different usage scenarios and apply it to our products.

About White Clarke Group

WCG is the world’s leader in end-to-end automotive and asset finance and consumer software solutions and consulting services. Its award-winning software platform offers the end-to-end solutions of choice for Automotive Finance and Asset Finance companies in 27 countries around the globe.

For more information please visit www.whiteclarkegroup.com

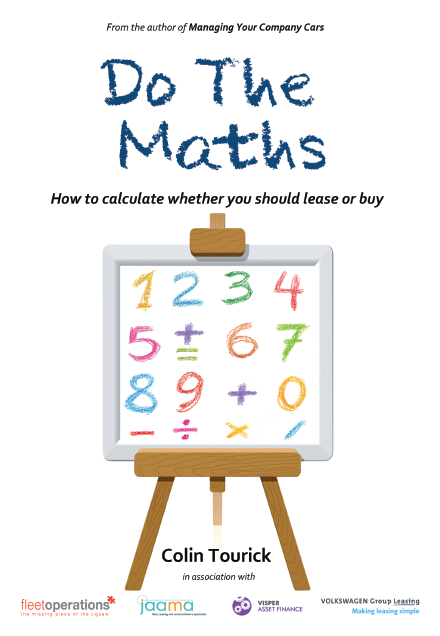

New book – Do The Maths

Eyelevel Books have just published Colin Tourick’s brand new book Do The Maths

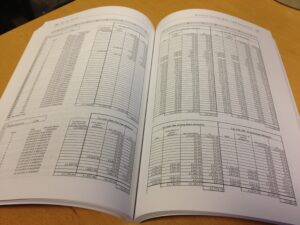

The book is a step-by-step guide to the mathematics of asset finance, covering discounted cash flow analysis and showing the reader how to use Excel to build tax-based DCF spreadsheets and to calculate finance instalment and interest rates.

The book is a step-by-step guide to the mathematics of asset finance, covering discounted cash flow analysis and showing the reader how to use Excel to build tax-based DCF spreadsheets and to calculate finance instalment and interest rates.

It includes an explanation of the different types of interest rate, payment profiles, the effect that residual values and balloon rentals have on rental calculations, fixed and variable rate transactions, FHBR, LIBOR and A & B factors.

Do The Maths includes comprehensive descriptions of the main ‘purchase-type’ finance agreements (outright purchase, hire purchase, conditional sale and credit sale), leases (contract hire, ‘open-book’, sale and lease back, finance lease) and other asset finance products (contract purchase, loans, bank overdrafts, ECO, schemes and salary sacrifice schemes). It also looks at methods for calculating early termination settlements for leases and other finance agreements.

The book sets out to explain the underlying principles that you can apply in any country, for any kind of asset and under any set of tax rules.

As Tourick says; “The financial side of asset finance is not that complicated: it just needs to be approached one step at a time.”

The book is published by Eyelevel Books in association with Volkswagen Financial Services, Fleet Operations Limited, Jaama and Visper Asset Finance. 191 pages. 33,600 words. ISBN 9781902528342

You can buy the book as a paperback or a PDF e-book and there is also a downloadable file containing all of the many Excel spreadsheets that are shown in the book.

Introducing the Asset Finance Pricing Review

Colin Tourick is the editor of Asset Finance Pricing Review, published by Asset Finance International. You can download a free copy here

The growth of business analytics

In our Pricing work we help client companies to use data in new ways in order to boost turnover and profitability. The following article from the BBC News website explains this approach rather well, and we were so impressed with it that we have reproduced it in full.

In today’s volatile business environment, organisations must be ready to reconfigure their strategic priorities at speed, and with certainty.

Crucially, instead of basing major business decisions on intuition, they need to mine the data and information at their disposal to drive rapid decision making.

This is why analytics – the use of data, statistical and quantitative analysis, explanatory and predictive models – has moved centre-stage.

According to market research firm IDC, the market for business analytics software grew 14 percent in 2011 and will hit US$50.7bn by 2016.

Of course, analytics itself is nothing new.

Organisations such as Google, Tesco and Caesars Entertainment are well recognised for their ability to predict market trends, customer behaviours and workforce staffing requirements and turn these into top-line growth and/or bottom line savings.

But for the many other businesses now seeking to take advantage of analytics, there continues to be a lack of clarity around certain fundamental questions.

What is analytics? How can it propel and improve an organisation’s competitive positioning or effectiveness?

What does it mean to truly become an analytical organisation? And how does an organisation set out on this critical journey?

Although the development of analytical capabilities and capacity is obviously important, a focus on data, methods and technology alone will not magically deliver the insights needed for competitive edge.

“A company’s leaders need to be able to create, champion and sustain an analytics vision”

Meaningful actions

The first step is to identify the information that must be harnessed, before establishing where it resides within the business, and under whose responsibility.

Equally important is understanding how this information can be captured effectively, and what needs to happen to turn insights into meaningful actions for the business.

Also essential, businesses must recognise that technological tools, sophisticated models and differentiating data count for little unless the organisation has the enterprise-wide capability and commitment to capitalise on them.

At a fundamental level, this means ensuring that analytics is not a siloed function. Only when it becomes truly integral to the business can it begin to support the broader strategic agenda.

How can this be achieved? Analytical leaders know that they must pull and align a number of levers to ensure the success of any analytics implementation.

Throughout the business, processes, talent, leadership, metrics and accountability all play a vital role and influence the outcome.

Clearly, companies making a foray into business analytics face a steep learning curve. Moving to fact-based decision-making requires a cultural transformation involving both top-down leadership and grassroots adoption of new behavioural norms.

It should be planned, addressed and measured just like any other change to the business. In other words, understand what needs to change, take a sequence of implementation actions and follow through to make the changes sustainable.

Stacy Blanchard believes analytics helps businesses make informed decisions quicker than ever before.

The market is already flooded with training on how to use the various applications required to carry out analytics work.

The result? Although many analysts are well equipped to use the software, higher level capabilities related to model development, impactful data interpretation and how best to take advantage of analytics are left to on-the-job training and, worse, to chance.

A closer look at the analytics talent gap, based on Accenture’s practical experience and research, indicates that all levels of the organisation must move to develop certain core skills.

A company’s leaders need to be able to create, champion and sustain an analytics vision. Managers need to be able to lead an analytics agenda and create a lasting impact for their team.

And front-line practitioners need to combine their technology abilities with problem solving and data analysis skills to increase their effectiveness and deliver bottom-line business benefits.

At an enterprise-wide level, businesses build analytical orientations by demonstrating a profound respect for data and fact-based decision-making.

Fundamentally curious

Crucially, however, their executives do not study things to death or delay decisions. They are willing to make tough calls based on the information available.

Analytical organisations are fundamentally curious. They find out what their peers are doing, they scrutinise performance patterns. And they identify new and better ways of working. If metrics suggest that a practice or process is no longer effective, the analytical organisation is not afraid to change them.

“Individuals should be recognised and rewarded for their analytical capability”

Analytical cultures are marked by collaboration and information sharing across organisational boundaries. If people hoard information and distributed groups of analysts cannot work together, the business cannot capitalise on the big opportunities for analytics.

Last but not least, individuals should be recognised and rewarded for their analytical capability – not just the quality of analyses and insights, but also the breakthrough business results achieved by putting them into action.

Realistically, at least in the early stages of an analytics implementation, many of these changes will take place in back-office functions.

Provided they keep abreast of these developments and work out how to complement them throughout the rest of the business, HR departments that have a strategic seat at the table will be key to advancing and supporting analytics implementations at scale across the business.

Equally important, CEOs and senior leadership, along with HR, will move to ensure that analytical talent – an increasingly precious resource – is engaged, retained and working on the most important growth opportunities and problems facing their organisations.

Article reproduced in full from BBC News website August 2012.

Comment on Electric Vehicles in Fleet World

Comments on the Chancellor’s budget

Leasing Life magazine reviews Managing Your Company Cars: Expert Opinion

The English lexicographer Samuel Johnson said “Knowledge is of two kinds. We know a subject ourselves, or we know where we can find information on it.”

When it comes to fleet management, Professor Colin Tourick has knowledge of the first kind and, luckily, has compiled the information in several handy books for those who do not.

Press report in Asset Finance International on leasing market consolidation speech

New Asset Finance International webinar series

Asset Finance International, the website for leasing experts around the world, has launched an ‘online conference’ for its 28,000 registered members, which Colin Tourick is chairing.

Experts on equipment finance, motor finance and fleet leasing from all major leasing regions across the world, are being asked to prepare and deliver presentations covering:

- An overview of their market in 2011

- Some positive developments in 2011

- Some negative developments in 2011

- Some reasons for lessors in their region/sector to be optimistic in 2012.

- The main challenges they will face in 2012

The first presentation has been recorded with Rafael Castillo-Triana of The Alta Group and you can download it here.

The series is sponsored by White Clarke Group.