[Article originally published in Fleet Leasing]

Next time you pop into a corner shop, have a chat with the owner behind the till. In many ways they are the perfect business person because they know everything about their business: the cost of every item they sell, the local competition, how much they have to pay every year in rent, rates, insurance and so on and how much they have to put in the till every week to cover these fixed costs and feed the family. Armed with all of this knowledge the owner finds it relatively easy to decide how much to charge for each item they sell.

I asked a local shopkeeper about his business recently. He told me that he has a great relationship with his customers, many of whom he has known for years. “However”, he said, “I’m here to make money, not friends”.

As businesses grow, roles and responsibilities begin to get divided up between different people and very soon there is no one person who knows everything. People are slotted into silos. They become great experts on their part of the business but they are not particularly familiar with the details of the work being carried out elsewhere in the organisation. Management has to be careful to ensure that decisions made in one part of the business that look perfectly reasonable when viewed through the prism of that department’s responsibilities are still optimal when it comes to meeting the needs of the overall business.

Let’s talk now about leasing company pricing. In most contract hire companies someone is responsible for obtaining new vehicle data, someone else negotiates discounts with dealers and someone else obtains VRB details and negotiates tactical deals with manufacturers. A team of people probably works on setting residual values, another team works on maintenance budgets and someone else works out the cost of funds for each period and deal profile. Taken together, these items form the cost elements for each vehicle for every term and mileage. Someone from each ‘silo’ pops their contribution into the pricing system. Given that each of these numbers has been arrived at by a process or negotiation or judgement, each leasing company has a different base cost for each vehicle. The sales director is then given a target volume and margin to hit and they do their best to ensure that they quote for each deal as well as they can.

There’s an analogy to be made here with cake-baking. If someone bought the flour they thought would be best for the job, someone else bought the dried fruit, someone else bought the sugar, someone else the butter, someone else decided the quantities to use and how to mix them up and someone else decided how long at what temperature to cook them, you might end up with the perfect cake. Or you might discover that it tasted absolutely awful, because no one person had an overview of what was going on and was thinking about the impact that each decision was going to have on the ultimate texture and flavour of the finished cake.

So, the trick for a contract hire company sales director is to gather together all of the information they can from inside and outside the organisation, assemble this in some way and use it to help them decide how much to quote in every situation. That’s quite a tall order!

All contract hire companies impose some level of control on their sales people to ensure they do not quote at suicidal prices. And all contract hire companies have some market knowledge available to help them to decide what rental to quote.

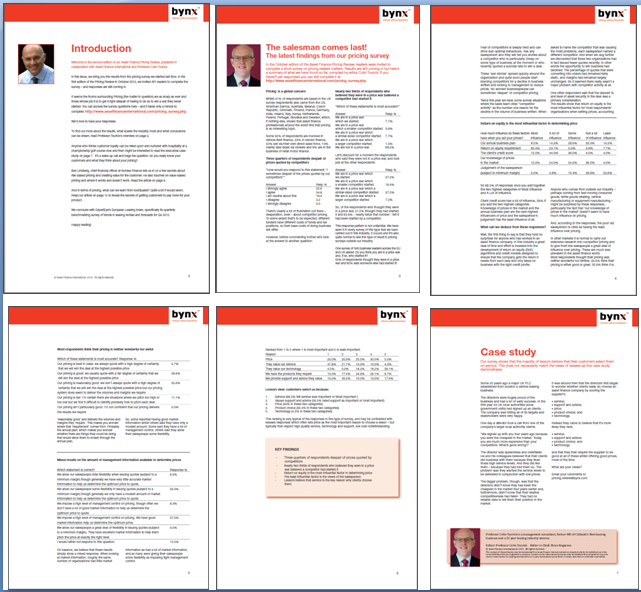

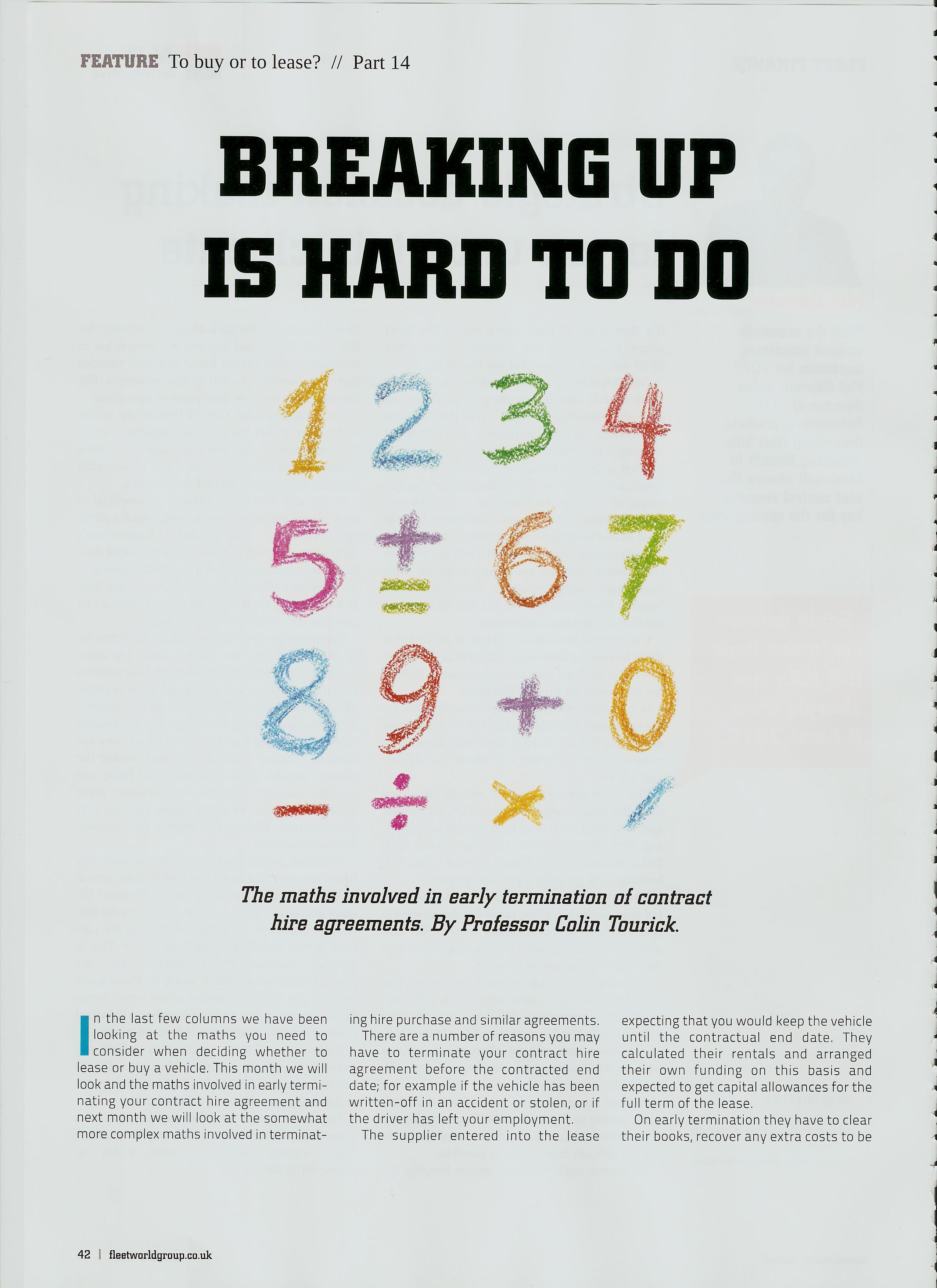

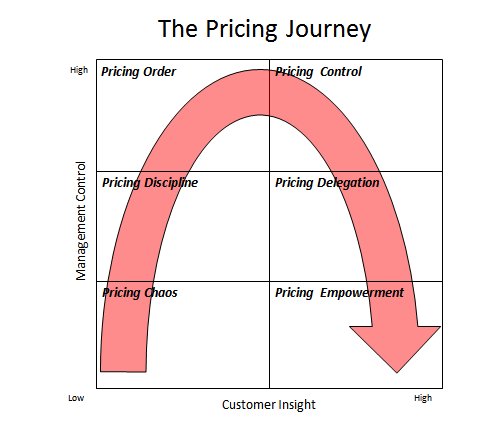

Here is an interesting tool that you can use to assess how well your company does its pricing. It’s called the Pricing Journey. For the purpose of this article, “price” means margin (which you might call “margin over cost of funds” or “overhead contribution”) plus cost (interest cost, maintenance cost and the other elements shown above).

For the purpose of this article, “price” means margin (which you might call “margin over cost of funds” or “overhead contribution”) plus cost (interest cost, maintenance cost and the other elements shown above).

This chart looks at two factors that will be present in every leasing company.

- Customer insight is the insight that you have into the way the client is likely to respond to your quote. Customer insight grows if you have a lot of market knowledge, a lot of experience in doing business with that particular customer and a real understanding of where your price sits in the market.

- Management control is the control that management introduces to minimise exposure to risk or sub-optimal decisions. So, in a pricing context, management exercises control by imposing minimum margins: the salesperson needs to refer to their line manager for approval to issue a quote below this limit.

If a company has low customer insight and low levels of management control, the result will be chaos. Salespeople will be issuing quotes ‘blind’, with no real idea whether they are pitching very high or very low. As there is no management control, this is a recipe for disaster.

Typically, management introduces controls to impose discipline. They try to gain greater insight into the prices that should be quoted so that opportunities are not being lost by quoting too high, whilst money is not being ‘left on the table’ by quoting too low. This is Pricing Order.

As management increases the amount of data it reviews and the analysis it carries out, it begins to recognise that it has information that it can provide to the salesperson that will increase the probability that the salesperson will be quoting optimum prices. ‘Optimum’ here means the price that maximises the probability of winning the deal whilst being as high as possible.

Management then develops ways to systemise this information, and can then start delegating some decision-making to the salesperson in the knowledge that quotes are being issued with the benefit of a good level of customer insight.

As the quality and quantity of data available to the salesperson at the point of sale improves, customer insight grows to the point that the salesperson can be empowered to issue quotes without very much management control or oversight at all. Management knows that the salesperson is so well informed about the company’s competitive position generally – and for each client specifically – that the salesperson can be empowered to make optimal pricing decisions.

This article is designed to provoke some thoughts. Where is your company on this chart? Are you in position 3, Pricing Order? What would you need to do to move to positions 4 or 5, Pricing Control or Pricing Delegation? Would it ever be possible for you to get to Pricing Empowerment? What would you have to do to get there and what would things look like when you arrived?

Many leasing companies have been looking at this issue. They have realised that all too often they issue quotes with no real idea of whether they are likely to be quoting £10 per month above the competitor’s quote, £10 below, or precisely where they need to be – a few pence below. They know for example that it makes no sense to apply one blanket margin to a particular client (“3% over cost of funds”) regardless of whether the client is ordering cars where the lessor’s RVs are high or low versus the market average. They also know that if they have recently issued 400 quotes on a particular make, model, period and mileage and won 80 of these, and issued 400 quotes on a different make, model, period and mileage and won 20 of these, this is probably telling them something about their relative competitiveness on those two deals and that they should use this insight to nudge up their pricing on one deal and nudge down their pricing on the other.

And they are coming to realise that it is necessary to have one person – one brain – sitting on top of all of the data and information at the company’s disposal in order to try to make sense of it and to use it to improve the way the business does its pricing.

Professor Colin Tourick