Tag Archives: Fleet management

Colin Tourick speaks at Fleet Event

Colin delivered a speech entitled “Should you lease or buy?” on behalf of Volkswagen Leasing Group to a group of senior fleet managers.

More information here

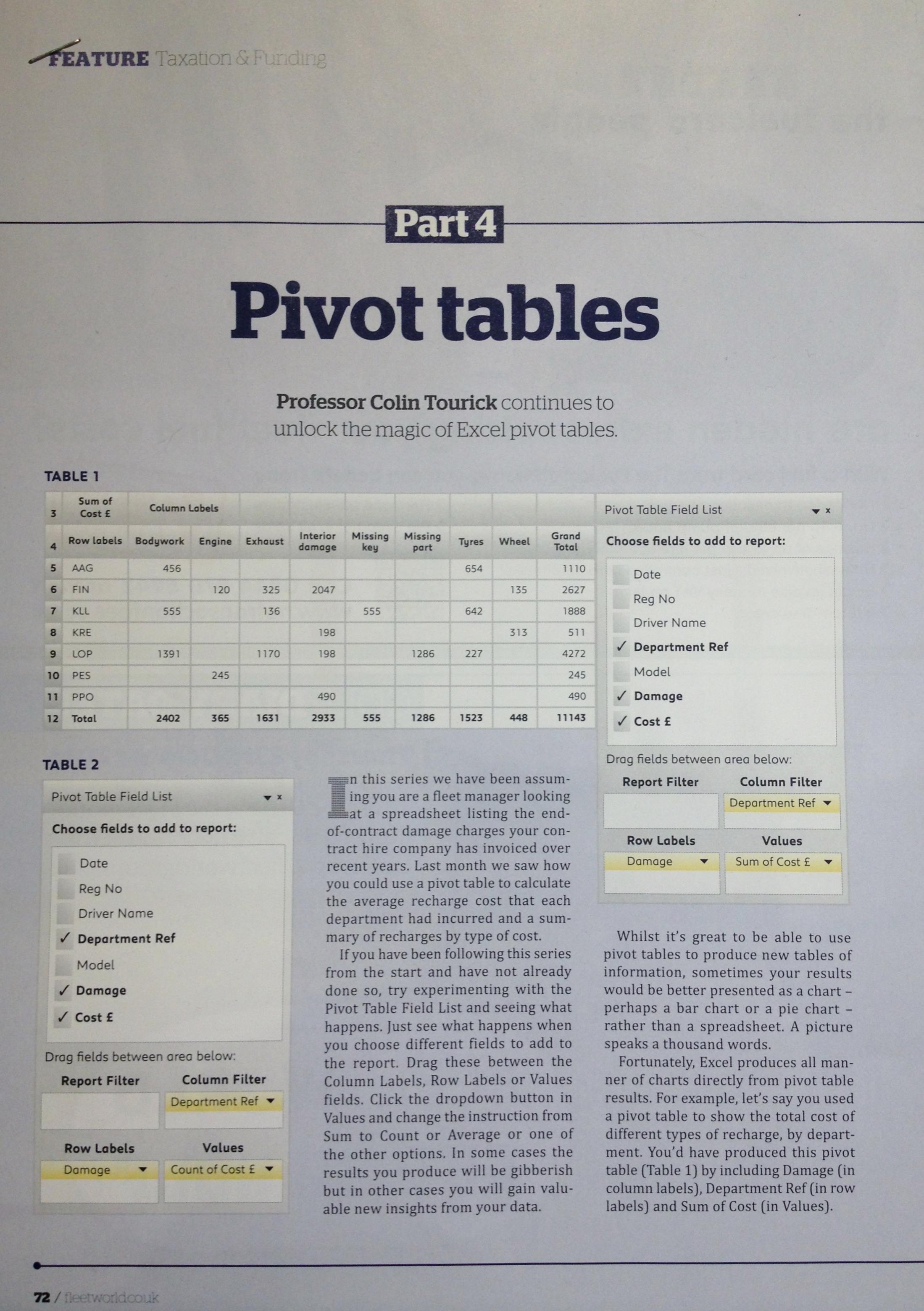

The magic of Excel pivot tables – Fleet World

VAT article published in Fleet World

Driving Business magazine reviews Do The Maths

Driving Magazine, part of Fleet News, has published a complimentary review of Colin Tourick’s book Do The Maths

You can read the review here

Auto Finance Software Marketplace – an insider perspective

At the February session of the Buckingham Automotive Forum, Colin Tourick interviewed Dara Clarke, CEO of White Clarke Group. Dara provided valuable insights about the asset finance software market and the interview is reproduced in full here.

Q: White Clarke Group has recently celebrated its 21st anniversary. What have you learned along the way?

A: Technology aside, the biggest single development has been the globalisation of the industry and there have been tough lessons for software solutions providers. The need for a local presence is a given. Apart from cultural differences, it would be difficult otherwise to support clients on a 24/7 basis.

Internalization is very difficult. We tried for years to break into the European and Asian markets but until we had local presence we had no traction. Local requirements differ vastly from one’s perception and clients will not take the risk of hiring outsiders. Internalization is now the big issue facing the industry as legislative requirements, global procurement by the multi nationals and fiscal compliance force clients to use common systems. System providers now have to act accordingly to cater for these trends and client needs. This is why we have invested so heavily establishing hubs in our North American hub in Toronto, Asia Pacific hub in Sydney, and European hub in Germany, with additional local offices in Austria, the USA, China and, shortly, in Brazil.

Another lesson has been the need to stick to the core. A number of companies have already learned that being a generalist does not seem to work. By adopting a very keen focus, we have been able to differentiate ourselves by offering unique insight and highly tailored systems to clients in the fleet, asset and captive finance industry.

Talent is scarce and is becoming even more difficult to find, so we have had to develop our staff by hiring graduates and training them in all aspects of the business. Sometimes we have to hire-in specific skills, but it is becoming increasingly difficult to identify the right talents. We also find that our clients do not have the internal resources they had, say, twenty years ago due to cost reduction. This means large systems implementations are being done by operational staff that still have the day job to do. This is not an ideal situation but one which is faced by all our industry.

It is also important to recognise that this industry is a parish, so one cannot fail or make enemies as a single slipup can ruin a reputation. Reputation is a key factor in winning new business, so having clients who will vouch for you, and the systems you provide, is the best advertising you can get. No one wishes to experiment or invest in bleeding-edge systems, hence the need for good references.

The biggest lesson, though, has to be — innovate or die. The speed of technological change, particularly since the internet became the common means of communication, is so fast that if you get left behind you can fail. When we look at the current competitors compared with those we faced in the early 90s, there are few who have survived and the failures generally can be put down to a failure to invest in talent and technology.

Technology is king. We are now in the ‘Google Age’ and, as such, technology has to cater for this. The necessary infrastructure and components for this new world are very complex. Software Providers need to build a pool of world-class talent that is able to build, deploy and maintain agile systems that are capable of facilitating rapid change.

Q: You have touched on globalization. How does the UK market compare with others?

A: The United Kingdom is more sophisticated in pricing terms than most other markets, to some degree a result of the maturity of its the asset and auto finance industries. Other markets enjoy stronger growth which makes lease business less risky in asset value terms.

Local market-specific pricing demands play very much into our hands as they can easily be configured into the system , given the component based nature of CALMS. This application architecture also allows clients to replace system components such as credit decisioning, collections or remarketing components on a piece meal basis and not have to replace all their systems at once.

Q: What ideas have White Clarke Group come up with that have worked particularly well?

A: I believe the biggest innovations were our development of the first internet-based point of sale system in Europe in 1997, the first JAVA enterprise Wholesale Finance System deployed in Europe in 1999. In the same year, we were the launch-partner with HP and Microsoft for hand-held internet based applications such as vehicle inspection, calculation engines and Whole Audit. We continue to invest in mobile technology and will make some major product announcements later this year about our latest mobile innovations.

In 2000, we commenced the development of a JAVA based processing system including Rules Based Decisioning Engine, Work Flow and Credit Decisioning linked with Document Management and imaging. This has been the biggest innovation and the core of our agile processing innovation, allowing clients to truly automate their processes and change as they wish, redesigning processes to cater for market needs without reference to our developers.

On the Fleet side, we commenced development of a radical redesign of traditional customer and vehicle care again using WEB based technology. Using new technologies, we have been able to automate all the regular processes associated with the industry such as P11D (expenses and benefits) calculation, fines management, vehicle ordering, location and delivery management

Pricing Generally – Our background was in pricing and tax based calculation in web based quote with RVs and SMR costs adjustments on factory fitted options; Profit margins flexible by asset value; preferred option functionality – all provide pricing accuracy across the full range of products, terms and mileages. VWFS UK and LeasePlan are main customers providing thousands of automatic ‘unmanned’ quotes a day via web portals – low overhead business capture

Q: How have client needs changed over the last 25 years?

A: Two changes stand out; clients have embraced innovation and they have embraced globalisation.

Clients now recognise that technology is the key to market advantage and profit enhancement. The GOOGLE-age customer wants instant access to quotations, vehicle specifications, financial approval and ordering. They recognise that any company without instant access suffers a distinct competitive disadvantage. Clients expect sophistication, reliability, performance and delivery on time – at less cost than 25 years ago. This is nothing new but, given the sophistication of the modern infrastructure, it is much more difficult from a technical support perspective. Margins have been squeezed and will continue to be under pressure. Today, the clients are all about innovation. As an example, they are using Apps for the IPhone or iPad, where drivers can book a rental on their hand-held device and even obtain a rental agreement without having any paper, sent straight from an iPad to their inbox.

The second element of change is that clients have expanded enormously in the last 20 years. Multi-product, multi-country availability 24/7 with 99.9 % availability has become a standard requirement, whereas 20 years ago each client subsidiary had nearly full independence. Central technology requirements and standard procurement were unheard of in most cases. Now procurement is a lengthy, complex and exacting process!

Q: How do you think leasing companies’ software requirements are likely to change in the next few years. What are the next ‘big things’ we should be looking out for?

A: Blending of dealer channel and central HQ-based business processes are now a key requirement for all clients. Our own latest solutions assume this multi-channel, multi-product, multi-language approach while catering for the needs of a consumer, dealer, sophisticated fleet user and a web customer, all using the same application.

Technology itself will be a major driver. There has never been as much fragmentation and uncertainty as there is now, all driven by our dependence on a mobile device. Our challenge is to tread carefully between the competing technologies. Eventually, tablets and smartphones will largely replace laptops, not because they are more capable, but because they are more applicable to the way we live. The challenge for software vendors like ourselves is to get to grips with the very different usage scenarios and apply it to our products.

About White Clarke Group

WCG is the world’s leader in end-to-end automotive and asset finance and consumer software solutions and consulting services. Its award-winning software platform offers the end-to-end solutions of choice for Automotive Finance and Asset Finance companies in 27 countries around the globe.

For more information please visit www.whiteclarkegroup.com

What a year!

2011 proved quite eventful for us.

The highlights were that we:

- Had 3 new books published

- Worked on the development of a new pan-Asian leasing company

- Worked on interesting projects in France and the Netherlands

- Helped to run 4 Buckingham Forums

- Worked on 9 small advisory projects, mainly for investors looking to buy into the UK fleet market

- Helped 3 major groups go out to tender for their global fleet requirements

- Developed our new price optimisation software

- Ran training and coaching sessions in 7 of the largest organisations in the UK

- Gave 11 public talks, mainly on fleet- and pricing- related topics

- Had a monthly column published in Fleet Week on the Mathematics of Leasing

- Had 12 other articles published

- Had 20,000 visitors to our website

- Sold nearly 3,000 books

Our plans for 2012 include:

- Building on the success of the Buckingham Forums

- Running fleet conferences in Australia and the Far East

- Implementing pricing software and solutions in a number of finance and leasing companies

- Publication of two new leasing books

Happy New Year!

Extract from Managing Your Company Cars: Expert Opinion published in Fleet News

Fleet management training

Fleet management training might require investment on the part of your company, but experts suggest a trained professional could cut the cost of running vehicles by 15 per cent. Managing vehicles requires understanding of complex factors, including legislation on health and safety, taxation as well as best practice on running costs. Many end up taking on responsibility for managing a company fleet as a small part of their role, while for others it is a full-time job for which they also have a support team.

According to James Langley, director and deputy chairman of the Institute of Car Fleet Management, there is a danger that if a new fleet manager without training continues as their untrained predecessor did, it could lead to a continuation of poor practices.

Writing in Managing Your Company Cars, edited by Colin Tourick, Langley said:

Press Release – 3rd edition of Managing Your Company Cars published

Colin Tourick has today published the 3rd edition of his fleet textbook Managing Your Company Cars, just a fortnight after launching his new tax book Company Car and Van Tax 2011-12.

This massive textbook – 550 pages – has been fully updated to October 2011. It is a comprehensive guide to vehicle management and leasing for the beginner and expert.

It is published in association with ALD Automotive and the taxation chapter was developed in conjunction with KPMG.

You can read reviews and see the contents pages.

There is no similar book on the market. Earlier editions have sold in 26 countries across the world.

Fleet News interviews Colin Tourick

What has been your biggest achievement in your current role?

I’ve spent 30 years helping fleet managers reduce costs and risk, and my mother would say my biggest achievement is producing five books under the ‘Managing Your Company Cars’ title (“my son the author”).

I’m also very proud of the work I’ve done for the last six years helping leasing companies improve the way they do their pricing.

And in the last year or so we’ve introduced those pricing methodologies to a number of companies outside the fleet sector.

It’s interesting that the things we’ve learned about pricing in the fleet leasing market are also of value to food manufacturers, electrical goods retailers, parts distributors and service companies.

Continues here: http://www.fleetnews.co.uk/feature/the-last-word-colin-tourick/39762/