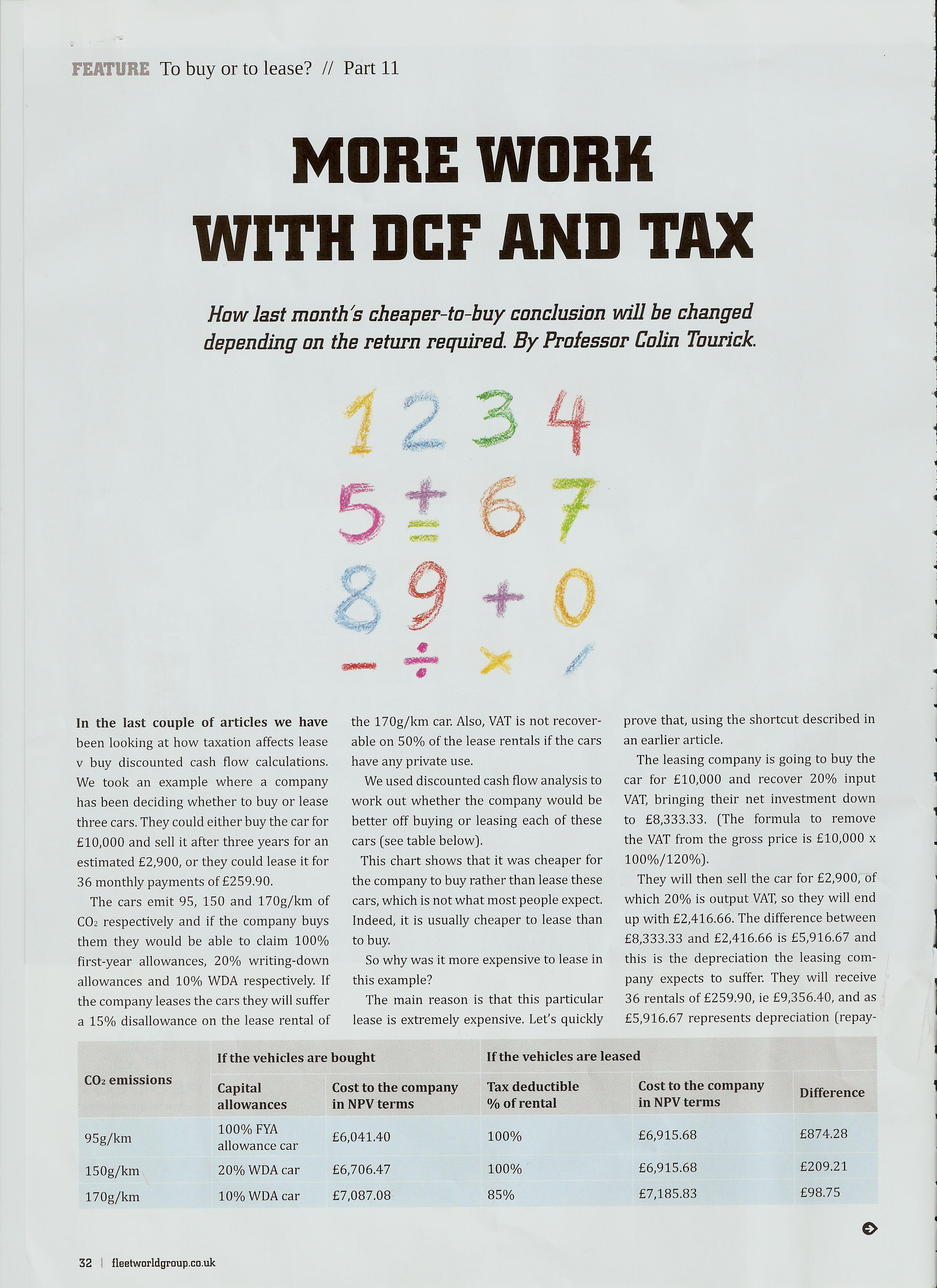

Eyelevel Books have just published Colin Tourick’s brand new book Do The Maths

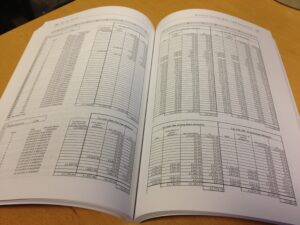

The book is a step-by-step guide to the mathematics of asset finance, covering discounted cash flow analysis and showing the reader how to use Excel to build tax-based DCF spreadsheets and to calculate finance instalment and interest rates.

The book is a step-by-step guide to the mathematics of asset finance, covering discounted cash flow analysis and showing the reader how to use Excel to build tax-based DCF spreadsheets and to calculate finance instalment and interest rates.

It includes an explanation of the different types of interest rate, payment profiles, the effect that residual values and balloon rentals have on rental calculations, fixed and variable rate transactions, FHBR, LIBOR and A & B factors.

Do The Maths includes comprehensive descriptions of the main ‘purchase-type’ finance agreements (outright purchase, hire purchase, conditional sale and credit sale), leases (contract hire, ‘open-book’, sale and lease back, finance lease) and other asset finance products (contract purchase, loans, bank overdrafts, ECO, schemes and salary sacrifice schemes). It also looks at methods for calculating early termination settlements for leases and other finance agreements.

The book sets out to explain the underlying principles that you can apply in any country, for any kind of asset and under any set of tax rules.

As Tourick says; “The financial side of asset finance is not that complicated: it just needs to be approached one step at a time.”

The book is published by Eyelevel Books in association with Volkswagen Financial Services, Fleet Operations Limited, Jaama and Visper Asset Finance. 191 pages. 33,600 words. ISBN 9781902528342

You can buy the book as a paperback or a PDF e-book and there is also a downloadable file containing all of the many Excel spreadsheets that are shown in the book.